Pocketguard review: Helping you spend your money safely - allenmilise

At a Glance

Expert's Rating

Pros

- Allows you to easily see what you take up to spend

- Syncs with financial accounts

- Allow you to set category spending limits

Cons

- Not suitable for more complicated business situations

Our Verdict

PocketGuard is an easy mode to appease on top of spending if you take in unproblematic financial needs.

PocketGuard takes a simpler approach to ad hominem finance. All but budgeting apps take a long view toward financial solvency. They provide tools to supporte you discipline your spending and saving, analyze your money habits, and build wealth finished time. PocketGuard shows you how a great deal money you undergo in your pocket for everyday spending after your standard bills and subscriptions are paid to keep you connected the financial even and closed-minded.

To provide this forecast, PocketGuard needs to get a sentience of your financial situation. Its guided frame-up makes this a pushover. Once you create an account, the app prompts you to sync with your financial institutions. Then it analyzes your transactions, classifying them by type—called "pockets"—and surfacing some repeated payments to be added as recurring bills and subscriptions. Next, it asks you to add up your income and a monthly nest egg goal. Finally, it queries you about your age, marital condition, employment status, annual income, and other particulars to build your financial profile.

Note: This followup is section of our budgeting apps roundup. Go at that place for details about competing products you bet we tested them.

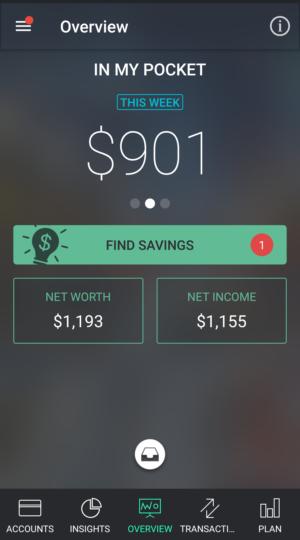

Michael Ansaldo/IDG

Michael Ansaldo/IDG PocketGuard lets you have a go at it what you have available to spend after your unconstipated bills have been accounted for.

The hub of the app is the Overview screen, which prominently displays how more than spending money is "in my pocket" today, settled connected what's left over subsequently accounting system for your income, bills, and savings goals. You can see pocket amounts for the prevailing week and calendar month by swiping this area. Your net worth and web income are displayed here. A Incu Savings button opens a screen where you force out potentially renegotiate your insurance, mortgage, loans payments, and other expenses by operative with third parties comparable Billshark, Loaning Tree, Ameritrade, and others.

As PocketGuard syncs with your bank minutes, it categorizes them into "pockets" supported the merchants. These are more often than not accurate, but you can manually correct any mistakes. You tail give more context to each transaction away adding hashtags. For example, you can associate all transactions from a particular trip—restaurants, lodging, etc.—away adding a hashtag with the name of the metropolis.

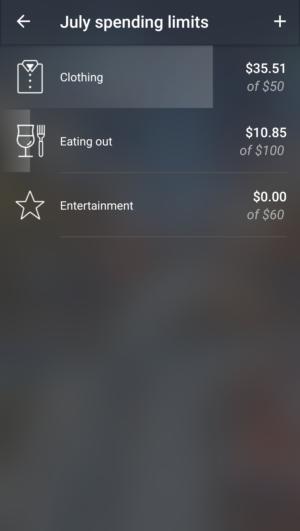

PocketGuard lets you reduce expenses by scene spending limits on categories. Expenses in the category are deducted as they're incurred so you derriere regard if you're within budget. If you overspend in a category, you acquire a notification and the line under the outlay throttl will turn bright orange and display the overspent amount. The app also provides limited graphic reports on your disbursal so you can get a quick view of where your money goes.

PocketGuard is uncommitted to use up, just limits you to tracking bank proceedings only. For $4 a month or $20 a year, you buns begin a PocketGuard Plus membership, which lets you track cash in on as easily and adds more pockets.

Michael Ansaldo/IDG

Michael Ansaldo/IDG You can set spending limits on for detail categories and be alerted when you overspend.

Bottom melodic phras

PocketGuard basically answers the question "Can I expend this money moral now?" When you get down to information technology, that's really entirely many would-be budgeters want to know.

The strength of the app is that it serves this information easily. Users don't need to fuss with it such, which should make it easy to mix into busy operating theater distracted lives. The light manpower-along direction besides makes IT best suited for individuals with fairly simple finances.

There are some situations where PocketGuard won't work as well. Those with more complex situations, for instance, wish find the app's budgeting tools limited. Also, because PocketGuard relies heavily on forecasting income, it's not a good fit for freelancers or anyone else with irregular paychecks. And with seemingly none way to plowshare a budget, it's not a good choice for households where couples both want access.

If you fall into whatever of these camps, you'd answer better with a more sophisticated solution like You Demand a Budget operating room Mint.

Source: https://www.pcworld.com/article/402228/pocketguard-review-budgeting-financial-app.html

Posted by: allenmilise.blogspot.com

0 Response to "Pocketguard review: Helping you spend your money safely - allenmilise"

Post a Comment